Journal Entry For Office Furniture . An office chair is either an expense or a fixed asset. Depreciation on furniture journal entry. Depending on the local laws, fittings may also be included in. How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. Journal entry for purchase furniture with cash. Office furniture is another necessary expense, especially if you’re outfitting a new space. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Office furniture is subject to depreciation. 8 steps to creating a profit and loss statement. Office supplies are usually considered an expense. The furniture is the fixed asset recorded on the company balance sheet. If your business uses any. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a.

from furniturewalls.blogspot.com

Depreciation on furniture journal entry. 8 steps to creating a profit and loss statement. Office supplies are usually considered an expense. Journal entry for purchase furniture with cash. Depending on the local laws, fittings may also be included in. An office chair is either an expense or a fixed asset. The furniture is the fixed asset recorded on the company balance sheet. Office furniture is subject to depreciation. How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. If your business uses any.

Bought Office Furniture For Cash Journal Entry Furniture Walls

Journal Entry For Office Furniture How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. Office furniture is subject to depreciation. Depreciation on furniture journal entry. How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. The furniture is the fixed asset recorded on the company balance sheet. Office furniture is another necessary expense, especially if you’re outfitting a new space. An office chair is either an expense or a fixed asset. Office supplies are usually considered an expense. Journal entry for purchase furniture with cash. If your business uses any. Depending on the local laws, fittings may also be included in. 8 steps to creating a profit and loss statement. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a.

From www.youtube.com

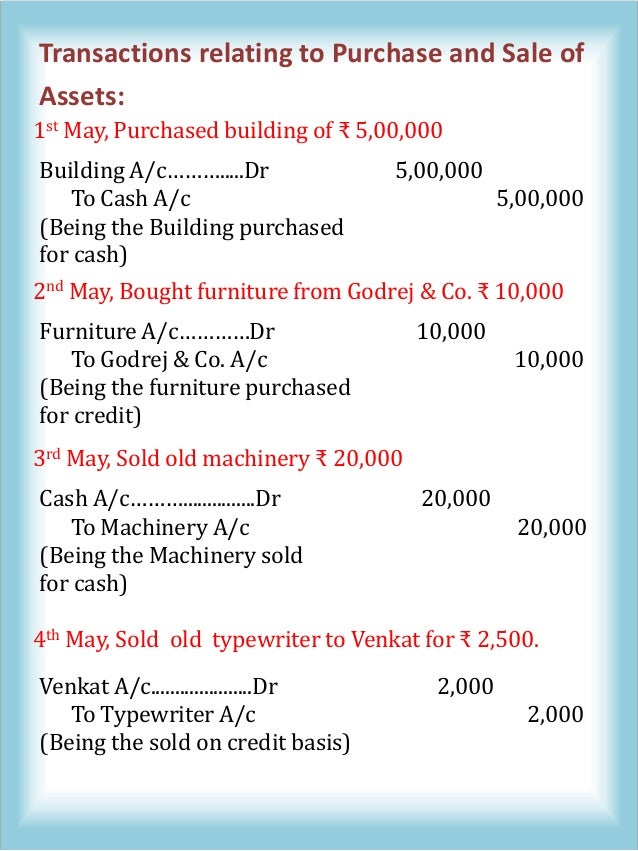

Journal_Entries Class_11 YouTube Journal Entry For Office Furniture Depending on the local laws, fittings may also be included in. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Journal entry for purchase furniture with cash. How you classify the office chair in your journal entry depends on whether the chair cost is. Journal Entry For Office Furniture.

From fundsnetservices.com

Journal Entry Examples Journal Entry For Office Furniture The furniture is the fixed asset recorded on the company balance sheet. How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Office. Journal Entry For Office Furniture.

From furniturewalls.blogspot.com

Bought Office Furniture For Cash Journal Entry Furniture Walls Journal Entry For Office Furniture If your business uses any. Journal entry for purchase furniture with cash. 8 steps to creating a profit and loss statement. Office supplies are usually considered an expense. Office furniture is subject to depreciation. An office chair is either an expense or a fixed asset. Depreciation on furniture journal entry. How you classify the office chair in your journal entry. Journal Entry For Office Furniture.

From biz.libretexts.org

7.2 Describe and Explain the Purpose of Special Journals and Their Journal Entry For Office Furniture 8 steps to creating a profit and loss statement. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. If your business uses any. Office furniture is another necessary expense, especially if you’re outfitting a new space. Office furniture is subject to depreciation. Bought office. Journal Entry For Office Furniture.

From tanklecture14.gitlab.io

Outstanding 30 Journal Entries With Ledger Trial Balance And Final Journal Entry For Office Furniture If your business uses any. 8 steps to creating a profit and loss statement. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Office supplies are usually considered an expense. Bought office furniture for cash journal entry is to record the purchases by debiting. Journal Entry For Office Furniture.

From www.transtutors.com

(Get Answer) A journal entry for a 300 payment to purchase office Journal Entry For Office Furniture Office furniture is another necessary expense, especially if you’re outfitting a new space. Depending on the local laws, fittings may also be included in. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. The furniture is the fixed asset recorded on the company balance. Journal Entry For Office Furniture.

From www.youtube.com

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube Journal Entry For Office Furniture Office furniture is subject to depreciation. An office chair is either an expense or a fixed asset. If your business uses any. 8 steps to creating a profit and loss statement. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Bought office furniture for. Journal Entry For Office Furniture.

From lasicamping.weebly.com

Lasicamping Blog Journal Entry For Office Furniture Office furniture is another necessary expense, especially if you’re outfitting a new space. Office furniture is subject to depreciation. Journal entry for purchase furniture with cash. Depreciation on furniture journal entry. How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. 8 steps to creating a profit and. Journal Entry For Office Furniture.

From www.aandmedu.in

A Beginner's Guide to Journal Entries A and M Education Journal Entry For Office Furniture Office furniture is another necessary expense, especially if you’re outfitting a new space. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a. If your business uses any. An office chair is either an expense or a fixed asset. The. Journal Entry For Office Furniture.

From www.youtube.com

QuickBooks Adjusting Journal Entry 6 Office Supplies YouTube Journal Entry For Office Furniture If your business uses any. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a. Journal entry for purchase furniture with cash. Depending on the local laws, fittings may also be included in. The furniture is the fixed asset recorded. Journal Entry For Office Furniture.

From www.brainkart.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Office Furniture How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. An office chair is either an expense or a fixed asset. Depending on. Journal Entry For Office Furniture.

From ar.inspiredpencil.com

General Ledger Entries Journal Entry For Office Furniture Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a. Office furniture is another necessary expense, especially if you’re outfitting a new space. Office supplies are usually considered an expense. If your business uses any. Depreciation on furniture journal entry.. Journal Entry For Office Furniture.

From fity.club

Journal American Period Furniture Journal Entry For Office Furniture Office supplies are usually considered an expense. An office chair is either an expense or a fixed asset. If your business uses any. Office furniture is another necessary expense, especially if you’re outfitting a new space. Depending on the local laws, fittings may also be included in. Depreciation on furniture journal entry. 8 steps to creating a profit and loss. Journal Entry For Office Furniture.

From rvsbellanalytics.com

Journal entries for lease accounting Journal Entry For Office Furniture An office chair is either an expense or a fixed asset. Office supplies are usually considered an expense. Depreciation on furniture journal entry. The journal entry for a cash purchase of furniture involves debiting the fixed asset account for the amount of the purchase and crediting the cash. Office furniture is subject to depreciation. How you classify the office chair. Journal Entry For Office Furniture.

From hadoma.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Office Furniture Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a. Depreciation on furniture journal entry. 8 steps to creating a profit and loss statement. Office supplies are usually considered an expense. If your business uses any. Depending on the local. Journal Entry For Office Furniture.

From www.youtube.com

Furniture Purchased Journal Entry (Cash / Cheque / Credit from RAM Journal Entry For Office Furniture How you classify the office chair in your journal entry depends on whether the chair cost is over or under your company's. 8 steps to creating a profit and loss statement. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s. Journal Entry For Office Furniture.

From www.youtube.com

Example of Merchandising Entries YouTube Journal Entry For Office Furniture If your business uses any. Office furniture is another necessary expense, especially if you’re outfitting a new space. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a corresponding credit to the bank gl or liability gl (if it’s a. An office chair is either an expense or a fixed asset. The. Journal Entry For Office Furniture.

From www.carunway.com

Sold Furniture Journal Entry CArunway Journal Entry For Office Furniture An office chair is either an expense or a fixed asset. Journal entry for purchase furniture with cash. The furniture is the fixed asset recorded on the company balance sheet. Depreciation on furniture journal entry. Office supplies are usually considered an expense. Bought office furniture for cash journal entry is to record the purchases by debiting the furniture with a. Journal Entry For Office Furniture.